Magnuson management – how well is it working?

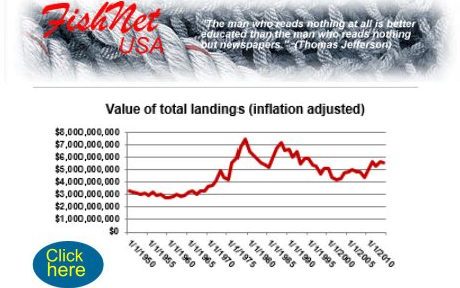

“Through investment and sacrifice on the part of our commercial and recreational fishermen, today, landings by U.S. commercial fishermen—and the value they get for those landings—are near all-time highs” The Governance of Fish: Forty Years under the Magnuson-Stevens Act, 04/11/2016, Sam Rauch (Deputy Assistant Administrator for Regulatory Programs, NOAA Fisheries) Periodically I like to do an overview of U.S. fisheries to give readers the opportunity to evaluate how their fisheries are doing relative to other domestic fisheries. This seems particularly relevant today, particularly considering Sam Rauch’s “happy birthday to us” anniversary statement up above. Nils Stolpe, FishNet USA Click here to read, and review the charts and graphs. 14:02

Another good piece by Nils. BUT = Behold the Underlying Truth, once again. ABUSIVE TRANSFER PRICING is not being considered. It makes inflation adjustments shrivel by comparison. For Alaska federal zone fisheries, since the implementation of the MSA in January 1977, there has been a resource rip-off over $50 billion in export wholesale transfer values, and that public larceny has caused $15 billion USA tax losses to our Treasury. Japan’s major fishing corporations, in a cartel fashion, operate foreign economic branch economies in Dutch Harbor (Bering Sea/Aleutian Islands) and Kodiak (Gulf of Alaska) groundfisheries, most particular for Pollock, bought excessively cheap from USA fleets delivered to Japanese-owned but English-named SHORESIDE subsidiaries.

.

That international structural economic arrangement allows them to transfer the Pollock production at falsely established intercompany values within their transnational corporatocracy. It is mainly done to avoid the drain of paying US Federal taxes in global trade. This is similar to Facebook (owes at least $5 billion in current IRS case), Microsoft, Apple, Google, and other companies who have Irish subsidiaries and other locations and scheme the Treasury not only of the USA but prevent them from paying taxes in any country.

.

I blew the whistle in the 1990’s in at least 3 cases for fishing transnationals. No, the revaluation needed has not occurred, and little in taxes (only a few million) was ever recovered. USA trawl fishermen seem happy with an arrangement that gives them ex-vessel prices only about a half to third of the same species delivered to foreign ports, in Japan for example. If fishermen don’t get educated, and get active protesting these globalization practices also known as “Briberization” in a structure also called a Kleptocracy, then they might as well swear allegiance to Japan and stop faking their treason against the USA. Seriously.

.

But Nils lost them at the inflation adjustment, and fishermen love to hate the IRS (like all “little Americans” who were taught to do so by Congress itself) snub their noses at removing this global crime. Funny thing, for the past few decades, New Bedford and other ports show highest rank in value on the known books, but that has not been true, as Alaska just shows what accounting trickery devalues, at bare minimum $1.4 billion not accounted for each year.

.

Who is responsible? Take ex-yeah-he’s-now-dead Senator Ted Stevens’ name off our fisheries act!!! If you are in the Arlington cemetery area, go unzip and water the grass on his treasonist grave. So sayeth the pro-USA advocates and patriots of Alaskan fisheries… as the truth cannot and will not be suppressed,

– Groundswell Fisheries Movement