Ocean Resource Privatization

Articles Posted by Date

The New England groundfish debacle (Part III): who or what is at fault? Nils E. Stolpe/FishNet

NILS STOLPE: The New England groundfish debacle (Part IV): Is cutting back harvest really the answer?

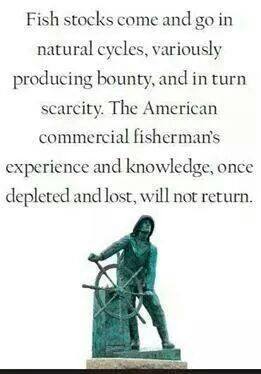

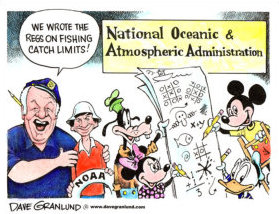

While it’s a fact that’s hardly ever acknowledged, the assumption in fisheries management is that if the population of a stock of fish isn’t at some arbitrary level, it’s because of too much fishing. Hence the term “overfished.” Hence the mandated knee jerk reaction of the fisheries managers to not enough fish; cut back on fishing. What of other factors? They don’t count. It’s all about fishing, because fishing is all that the managers can control; it’s their Maslow’s Hammer. When it comes to the oceans it seems as if it’s about all that the industry connected mega-foundations that support the anti-fishing ENGOs with hundreds of millions of dollars a year in “donations” are interested in controlling. Read the article here

-

Recent Posts

-

Grundéns Unveils Innovative New Offerings for Commercial Fisherman

Grundéns is proud to introduce its latest range of innovative new products designed with the extreme demands of commercial fishermen squarely in mind. With nearly 100 Read More » -

MOU to Advance Wind Energy Cannot Be at Expense of Fishing Industry

December 6, 2023 – FFAW-Unifor is dismayed at today’s news from the provincial and federal governments announcing a Memorandum of Understanding (MOU) aimed at expediting the Read More » -

After year in DC, NMFS Chris Oliver reflects on fisheries progress

Chris Oliver has had a busy year since he made the leap from Anchorage to Washington, D.C. to take the lead job at the National Marine Read More » -

Coast Guard, local agencies rescue fisherman near MacMillan Pier in Provincetown

A Coast Guard 47-foot Motor Lifeboat crew along with the Provincetown Harbormaster and Provincetown Police and Fire Departments rescued a fisherman after he fell overboard Saturday Read More » -

Rhode Island Fishermen’s Alliance Weekly Update, October 26, 2014

The Rhode Island Fishermen’s Alliance is dedicated to its mission of continuing to help create sustainable fisheries without putting licensed fishermen out of business.” Read the Read More » -

The “Silver Wave” – Herring run tied to the salmon cycle

The milky blue water comes alive as a massive ball of silvery herring mass together to prevent predators from feeding on them. The protective sphere, or Read More » -

Progress expected for Rhode Island’s offshore wind farm plan

Much was made of the Raimondo administration’s selection in 2018 of a proposal for a massive offshore wind farm off the Rhode Island coast that would Read More » -

Blue crab bait could improve crab, shrimp industries, LSU researchers say

BATON ROUGE — A new gelatin-like bait using shrimp waste could improve the way blue crabs are caught along the coast of Louisiana and add value Read More » -

Small sizes temporarily closes shrimp seasons in Mississippi and Louisiana

The Mississippi Department of Marine Resources is temporarily closing shrimping north of the Intracoastal Waterway in Mississippi waters at 6 a.m. on June 18. The closing Read More » -

Blown Away: Offshore wind regulators ignore danger to fishing industry

“This industry, this group of people in the room today, really are the key to unlocking that clean energy future,” Beaudreau, the deputy secretary of the Read More » -

Water War: Florida and Georgia to blame for oyster loss

The 2010 Deepwater Horizon disaster threatened to spread oil from Texas to Florida and kill every shrimp, snapper and oyster in the Gulf of Mexico. Oystermen Read More » -

Starts Tomorrow! The Pacific Fishery Management Council Meeting in Sacramento – Listen Live!

The Pacific Fishery Management Council (Council) and its advisory bodies will meet March 7-13, 2014 in Sacramento, California to address issues related to salmon, Pacific halibut, Read More » -

Lobster prices hit record high in southwest N.S.

A record high for lobster prices in southwestern Nova Scotia. It’s going for about 19 dollars a pound on the wharf. It’s a great price for Read More » -

Unemployed? How ’bout a sweet gig at World Wildelife Fund!

World Wildlife Fund (WWF), the world’s leading conservation organization, seeks a Director of Seafood Engagement for Business and Industry. No mention of salary, though. Read more Read More » -

A S M F C Northern Shrimp Section to decide on closure today in Portland

Federal regulators are set to decide if the fishing season for Gulf of Maine shrimp will be canceled for a second straight season. A report by Read More » -

Cape Breton man taken into custody after protesting on roof of CTV Atlantic

A Cape Breton man was taken into police custody after he took his protest over the snow crab fishery to the roof of CTV Atlantic in Read More » -

Confrontation: Far North locals blaming commercial fishing for dwindling fish stock

A group of Far North locals who blame commercial fishermen for their dwindling fish stock are taking matters into their own hands. Karikari Peninsula residents are Read More » -

Dwayne Samson begins trial for Phillip Boudreau’s death

A Cape Breton fishing boat captain accused of killing a man on the water begins his trial Tuesday in a case that has rocked the village of Petit-de-Grat to Read More » -

Appeals court orders state board to reconsider Atlantic City windfarm

The order requires the BPU to reconsider Fishermen’s Energy’s application to build the 25-megawatt project — which it rejected in April while citing costs to ratepayers Read More » -

Dunston’s will restore city’s historic Arctic Corsair and Spurn Lightship

A Hull-based ship repair firm has been appointed to restore two of the city’s most historic vessels. Dunston’s (Ship Repairs) Limited will carry out the work Read More » -

NCFA Weekly Update for March 18, 2024

The South Atlantic Fisheries Management Council (SAFMC) met the first full week of March in Jekyll Island, Georgia. The main items discussed at this meeting were Read More » -

Fisheries rights trial for 4 Mi’kmaw fishermen delayed

The trial for Ashton Joseph Bernard, 31, Arden Joseph Bernard, 22, Rayen Gage Frances, 22 and Zachery Cuevas Nicholas, 34 was supposed to begin Friday morning Read More » -

Coast Guard medevacs sick fisherman 6 miles off Nantucket

A Coast Guard Air Station Cape Cod aircrew medevaced a 40-year-old man experiencing abdominal pain Tuesday six miles southwest of Nantucket. The captain of the fishing Read More » -

Ocean Blasting Opposed by Members of Congress

The plan, proposed by the Bureau of Ocean and Energy Management last year, would open the Mid-Atlantic to seismic surveys, using sound blasts louder than a Read More » -

Special Management Zones SMZs approved for Delaware reefs

Forces fighting to get commercial fishing gear off artificial reefs got a boost on Wednesday at the Mid-Atlantic Fisheries Management Council (MAFMC) meeting in Virginia. Read Read More »

-

Archives

- April 2024 (112)

- March 2024 (209)

- February 2024 (192)

- January 2024 (211)

- December 2023 (188)

- November 2023 (202)

- October 2023 (180)

- September 2023 (101)

- August 2023 (241)

- July 2023 (237)

- June 2023 (211)

- May 2023 (235)

- April 2023 (210)

- March 2023 (215)

- February 2023 (179)

- January 2023 (187)

- December 2022 (178)

- November 2022 (187)

- October 2022 (190)

- September 2022 (177)

- August 2022 (203)

- July 2022 (186)

- June 2022 (184)

- May 2022 (186)

- April 2022 (190)

- March 2022 (219)

- February 2022 (167)

- January 2022 (192)

- December 2021 (191)

- November 2021 (182)

- October 2021 (196)

- September 2021 (197)

- August 2021 (205)

- July 2021 (221)

- June 2021 (211)

- May 2021 (221)

- April 2021 (204)

- March 2021 (202)

- February 2021 (188)

- January 2021 (195)

- December 2020 (193)

- November 2020 (181)

- October 2020 (204)

- September 2020 (195)

- August 2020 (189)

- July 2020 (205)

- June 2020 (194)

- May 2020 (225)

- April 2020 (218)

- March 2020 (216)

- February 2020 (209)

- January 2020 (233)

- December 2019 (227)

- November 2019 (240)

- October 2019 (241)

- September 2019 (241)

- August 2019 (270)

- July 2019 (288)

- June 2019 (270)

- May 2019 (263)

- April 2019 (223)

- March 2019 (210)

- February 2019 (155)

- January 2019 (117)

- December 2018 (216)

- November 2018 (169)

- October 2018 (218)

- September 2018 (247)

- August 2018 (258)

- July 2018 (259)

- June 2018 (250)

- May 2018 (251)

- April 2018 (247)

- March 2018 (266)

- February 2018 (256)

- January 2018 (278)

- December 2017 (309)

- November 2017 (281)

- October 2017 (288)

- September 2017 (275)

- August 2017 (284)

- July 2017 (287)

- June 2017 (273)

- May 2017 (276)

- April 2017 (275)

- March 2017 (300)

- February 2017 (252)

- January 2017 (288)

- December 2016 (263)

- November 2016 (268)

- October 2016 (287)

- September 2016 (284)

- August 2016 (293)

- July 2016 (286)

- June 2016 (273)

- May 2016 (246)

- April 2016 (267)

- March 2016 (260)

- February 2016 (265)

- January 2016 (269)

- December 2015 (266)

- November 2015 (281)

- October 2015 (289)

- September 2015 (286)

- August 2015 (298)

- July 2015 (294)

- June 2015 (329)

- May 2015 (316)

- April 2015 (317)

- March 2015 (324)

- February 2015 (301)

- January 2015 (332)

- December 2014 (322)

- November 2014 (330)

- October 2014 (382)

- September 2014 (340)

- August 2014 (347)

- July 2014 (376)

- June 2014 (401)

- May 2014 (344)

- April 2014 (341)

- March 2014 (375)

- February 2014 (374)

- January 2014 (360)

- December 2013 (294)

- November 2013 (372)

- October 2013 (391)

- September 2013 (461)

- August 2013 (566)

- July 2013 (526)

- June 2013 (447)

- May 2013 (475)

- April 2013 (508)

- March 2013 (459)

- February 2013 (352)

- January 2013 (265)

- December 2012 (206)

- November 2012 (168)

- October 2012 (187)

- September 2012 (126)

- August 2012 (4)

Tags

Alaska Alaska Department of Fish and Game Athearn Marine Agency Atlantic States Marine Fisheries Commission Boat of the Week BOEM Brexit British Columbia California canada Coast Guard commercial fisherman commercial fishermen commercial fishing Coronavirus Department of Fisheries and Oceans DFO Dungeness crab FFAW FISH-NL Gulf of Maine Gulf of St. Lawrence lobster Louisiana maine Maine Lobstermen’s Association massachusetts National Marine Fisheries Service new-england-fishery-management-council Newfoundland and Labrador New Jersey NMFS NOAA North Atlantic right whale North Carolina Fisheries Association North Pacific Fishery Management Council Nova Scotia Obituary offshore wind offshore wind farm offshore wind farms Oregon Scotland United Kingdom weekly update

Comments

- Cindy on More things to worry about by Jerry Leeman

- Mark on More things to worry about by Jerry Leeman

- Joel Hovanesian on Where Have All The Right Whales Gone?

- Sid Hounsell on BREAKING: FFAW AND ASP REACH AGREEMENT TO GET SNOW CRAB FISHERY STARTED

- Sid Hounsell on BREAKING: FFAW AND ASP REACH AGREEMENT TO GET SNOW CRAB FISHERY STARTED

- Scott on California’s ocean salmon fishing season closed for second year in a row

- Fran Szymanek on Offshore Wind Electrical Substations; The Secret, Silent Killers by Jim Lovgren

- Nils Stolpe on Time to save the Right Whale from the Green-Left

- Joel Hovanesian on Time to save the Right Whale from the Green-Left

- Chris Iversen on California – Crabbers likely to use new gear next season

- Nils Stolpe on Time to save the Right Whale from the Green-Left

- John Harrison jr on NOAA/NMFS Ignores Dangerous Sound Levels from Pile Driving – By Jim Lovgren

- Chip J on Overspreading Since the Seventies

- borehead - Moderator on Time to save the Right Whale from the Green-Left

- Mike Jacobs on Time to save the Right Whale from the Green-Left

- Joel Hovanesian on East End fishermen uneasy over wind farm South Fork Wind

- Jason taylor on Mi’kmaw fishers say DFO officers left them to walk for hours at night after seizing boots, phones

- Brick Wenzel on East End fishermen uneasy over wind farm South Fork Wind

- Chris Kinder on ENGO Sues UK Government Over International Fishing Quotas

- borehead - Moderator on Mystic Aquarium (the Whale People) expands offshore wind exhibit with youth in mind

- Kath on Mystic Aquarium (the Whale People) expands offshore wind exhibit with youth in mind

- John Harrison jr on Commercial fishermen react to MFC mullet decision

- borehead - Moderator on The CARES Act: Lengthy Process, Little to Show for Connecticut Fisheries

- Randall on The CARES Act: Lengthy Process, Little to Show for Connecticut Fisheries

- Oscar navarrete on Sam Parisi asks, How Accurate is NOAA and NOAA Fishery Survey Science?

- Oscar navarrete on Sam Parisi asks, How Accurate is NOAA and NOAA Fishery Survey Science?

- sam on Darren Byler files Two Multi-Million Dollar Lawsuits Against the Coast Guard and the City of Kodiak for the Illegal Sinking of the M/V Wild Alaskan

- Charles on For a 2nd day, harvesters call on N.L. government to open market to outside buyers

- Clint Collamore on Maine Lobstermen’s Association tallies its victories, future risks at annual meeting

- Mike Amari on Capt. Charlie Griffin, ‘Wicked Tuna’ star, dies in boating accident on the Outer Banks; passenger missing

-

Facebook

Very entertaining article, but it misses a most important

cause of such alleged illegal activity: namely the privatization and onsolidation scam of Individual Transferable Quota management programs or “catch shares”.

The imposition of this management scheme in 2010 on the Northeast Groundfishery resulted after millions were spent by the Environmental Defense Fund and by NOAA to fulfill this commodification of the fishery. It has eliminated over half of the family-owned and family funded fishing operations. Such fishing operations consisting of one or two vessels per family, had more

than adequate level of “accountability” of catches and landings. Such small operations are cross-checked at least 5 different ways, by 3 different government agencies.

Also, it’s hard to get independent fishermen to agree on anything no less get them to all risk their future by smuggling a few hundred dollars worth of fish, which would be about the illegitimate gain on their small scale landings. Large “vertically integrated” corporate style companies, on the other hand, rely on the integrity of one or a few individuals to do the right thing. They operate in volumes that can invite and then easily obfuscate some sleight of hand dealings

NOAA’s and various eco-NGO’s campaigns of pushing catch shares has resulted in opening the door wide to create these corporate style fish companies. Any market-cap corporation or any well-funded ambitious individual or group of investors is invited to own more quota then they are able or willing to manage responsibly and legitimately—and as Wall Street has taught us: the bigger, the less accountable or “Too Big to Monitor”?

Also, this New Bedford matter is not “an extreme case” it’s happening worldwide, and will continue to happen with large conglomerate fish quota “holding companies” such as Pacific Andes’ China Fishery—a huge company of factory trawler/freezer ships notorious for illegitimate fishing and is currently in Chap. 11 dodging investors. Corporate free-for-alls and political skullduggery can often be found where fish have been commoditized and put in the hands of a “Too Big to Monitor” business entity which is concerned solely with bottom line quarterly profits.

Carlos owned many boats and licenses long before the imposition of catch shares, but this type of alleged mismanagement is accelerated, if not encouraged, by a consolidation encouraging catch shares regime.

To analyze causes, look to the catch shares “business plan” as a major culprit, creating an environment that fosters consolidation and monopolization and all the administrative chicanery that accompanies those mega-corporate style ambitions.

Very entertaining article, but it misses a most important

cause of such alleged illegal activity: namely the privatization and consolidationscam of Individual Transferable Quota management programs or “catch shares”.

The imposition of this management scheme in 2010 on the Northeast Groundfishery resulted after millions were spent by the Environmental Defense Fund and by NOAA to fulfill this commodification of the fishery. It has eliminated over half of the family-owned and family funded fishing operations.

Such family fishing operations consisting of one or two vessels per family, have more than adequate levels of “accountability” of their catches and landings. And small operations are cross-checked at least 5 different ways, by 3 different government agencies.

Also, it’s hard to get independent fishermen to agree on anything no less get them to all risk their future by smuggling a few hundred dollars worth of fish, which would be about the illegitimate gain on their small scale landings.

Large “vertically integrated” corporate style companies, on the other hand, rely on the integrity of one or a few individuals to do the right thing. They operate in volumes that can invite and then easily obfuscate some sleight of hand dealings

NOAA’s and various eco-NGO’s campaigns of pushing catch shares has resulted in opening the door wide to create these corporate style fish companies. Under this management regime any market-cap corporation or any well-funded ambitious individual, or group of investors, is invited to own more quota then they might be able or willing to manage responsibly and legitimately—and as Wall Street has taught us: the bigger, the less accountable or “Too Big to Monitor”?

Also, this New Bedford matter is not “an extreme case” it’s happening worldwide, and will continue to happen with large conglomerate fish quota “holding companies” such as Pacific Andes’ China Fishery—a huge company of factory trawler/freezer ships notorious for illegitimate fishing and is currently in Chap. 11 dodging investors.

Corporate free-for-alls and political skullduggery can often be found where fish have been commoditized and put in the hands of a “Too Big to Monitor” business entity which is concerned solely with bottom line quarterly profits.

Carlos owned many boats and licenses long before the imposition of catch shares, but this type of alleged mismanagement is accelerated, if not encouraged, by a consolidation encouraging catch shares regime.

To analyze causes, look to the catch shares “business plan” as a major culprit, creating an environment that fosters consolidation and monopolization and all the administrative chicanery that accompanies those mega-corporate style ambitions.