Tag Archives: tax evasion

Federal memo estimates more than $176M of Atlantic lobster catch unreported, untaxed

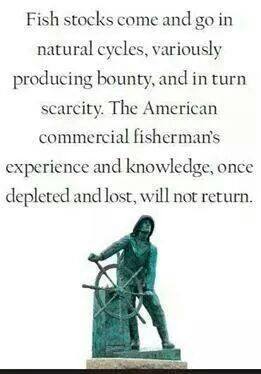

The federal Department of Fisheries and Oceans suspects hundreds of millions of dollars’ worth of lobster is caught in Atlantic Canadian waters each year but never reported to authorities, raising both tax evasion and conservation implications in the country’s largest fishery. An internal memo in August to DFO’s deputy minister said it’s estimated that between 10 and 30 per cent of lobster landings in the region are unreported, and the department said in a statement it is working to map out criminal networks and money laundering in the sector. “It’s mind-boggling,” said Osborne Burke, the president of the Nova Scotia Seafood Alliance, which represents about 150 lobster buyers and processors and has urged a crackdown on unreported cash sales. more, >>CLICK TO READ<< 06:44

Midcoast man again charged with violating Maine’s baby eel fishing laws

A Waldoboro man who nine years ago was convicted of tax evasion and underreporting hundreds of thousands of dollars in eel fishing income has been charged again with violating Maine’s elver fishing laws. Paul J. Griffin Jr., 52, has been charged with selling juvenile eels, also known as elvers or glass eels, for cash, which is a violation of laws implemented in 2013. Despite the recent charges against Griffin and a handful of others, Maine has had a relatively low number of similar violations for the past decade. It’s been a different story across the border in New Brunswick and Nova Scotia, where an alleged spree of elver poaching prompted Canada to shut down the fishery this spring. more, >>CLICK TO READ<< 09:46

A Waldoboro man who nine years ago was convicted of tax evasion and underreporting hundreds of thousands of dollars in eel fishing income has been charged again with violating Maine’s elver fishing laws. Paul J. Griffin Jr., 52, has been charged with selling juvenile eels, also known as elvers or glass eels, for cash, which is a violation of laws implemented in 2013. Despite the recent charges against Griffin and a handful of others, Maine has had a relatively low number of similar violations for the past decade. It’s been a different story across the border in New Brunswick and Nova Scotia, where an alleged spree of elver poaching prompted Canada to shut down the fishery this spring. more, >>CLICK TO READ<< 09:46

Massachusetts Commercial Fisherman Sentenced to Prison for Tax Evasion

A Massachusetts man was sentenced today to 18 months in prison for evading taxes on income he earned as a commercial fisherman. According to court documents, Joaquin Sosa, of New Bedford, worked as a commercial fisherman and deckhand operating primarily out of the Port of New Bedford. Despite receiving approximately $1.9 million in income between 2012 and 2021, Sosa did not file tax returns reporting the income and did not pay the substantial income taxes owed on the income he earned. Sosa also worked under false identities over the years. To further conceal the source and disposition of his income, Sosa cashed his paychecks from fishing companies at check-cashing businesses, at times using false identities, and used the cash to fund his personal lifestyle. In total, Sosa caused a tax loss to the IRS of $520,415. >>click to read<< 19:34

A Massachusetts man was sentenced today to 18 months in prison for evading taxes on income he earned as a commercial fisherman. According to court documents, Joaquin Sosa, of New Bedford, worked as a commercial fisherman and deckhand operating primarily out of the Port of New Bedford. Despite receiving approximately $1.9 million in income between 2012 and 2021, Sosa did not file tax returns reporting the income and did not pay the substantial income taxes owed on the income he earned. Sosa also worked under false identities over the years. To further conceal the source and disposition of his income, Sosa cashed his paychecks from fishing companies at check-cashing businesses, at times using false identities, and used the cash to fund his personal lifestyle. In total, Sosa caused a tax loss to the IRS of $520,415. >>click to read<< 19:34

Profitable Port of New Bedford draws IRS scrutiny of tax evading fishermen

As the nation’s number one commercial fishing port, New Bedford is very much on the radar. “The statistics we have cover the six New England states but really the fishing industry is significant in Rhode Island, Maine and Massachusetts, with, of course, New Bedford being the most valuable port not only in New England but in the United States,” said IRS Criminal Investigation Supervisory Special Agent Matthew Amsden. Seven New England fishermen, including three from New Bedford and one from Fall River, were charged last month with tax evasion and failing to file returns. The other three indicted were from Rhode Island, according to a press release from the IRS Criminal Investigation unit. >click to read< 07:40

Fishing boat captain from East Lyme pleads guilty in tax evasion case

Peter P. Torres, a commercial fishing boat captain from East Lyme, pleaded guilty Monday in U.S. District Court to failing to file tax returns on approximately $1.27 million he earned between 2006 and 2011. Torres, 47, waived his right to indictment and pleaded guilty in New Haven before Chief U.S. District Judge Janet C. Hall to one count of attempted tax evasion. According to the office of U.S. Attorney Deirdre M. Daly and court documents, from 2006 to 2011 Torres failed to file tax returns ,,, Read the article here 09:32

Peter P. Torres, a commercial fishing boat captain from East Lyme, pleaded guilty Monday in U.S. District Court to failing to file tax returns on approximately $1.27 million he earned between 2006 and 2011. Torres, 47, waived his right to indictment and pleaded guilty in New Haven before Chief U.S. District Judge Janet C. Hall to one count of attempted tax evasion. According to the office of U.S. Attorney Deirdre M. Daly and court documents, from 2006 to 2011 Torres failed to file tax returns ,,, Read the article here 09:32

Feds offer more details on illegal lobster sales – possible investigation into tax evasion by lobstermen