Tag Archives: Deductible expenses

Top Tax Tips for those in the Commercial Fishing Industry

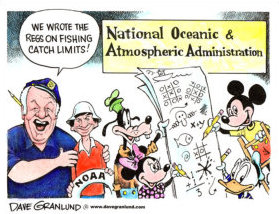

It’s never too late to educate yourself and catch up with the tax (and accounting) requirements in certain industries, such as commercial fishing. The following article discusses some general principles and tax tips for clients or prospects in the commercial fishing industry. Self-employed status: A fisherman is considered self-employed (and not an employee) and required to pay SE tax if he/she meets the following conditions: Receives a share of the catch or proceeds from the catch, The share depends on the amount of the catch, Receives a share from a boat with an operating crew of normally fewer than 10 individuals, Generally, does not receive money from work other than a share of catch or proceeds, continues, >click to read<16:59