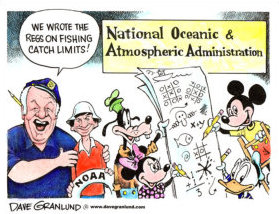

Solar And Wind – Taxpayer-Funded Ponzi Schemes with renewable portfolio laws, or quotas created by your elected politicians

The solar electricity industry is dependent on federal government subsidies for building new capacity. The subsidy consists of a 30% tax credit and the use of a tax scheme called tax equity finance. These subsidies are delivered during the first five years. For wind, there is a subsidy during the first five to ten years resulting from tax equity finance. There is also a production subsidy that lasts for the first ten years. The other subsidy for wind and solar, not often characterized as a subsidy, is state renewable portfolio laws, or quotas, that require that an increasing portion of a state’s electricity come from renewable sources. >click to read< 13:58

Leave a Reply