Tag Archives: Jeremy Woodrow

Market conditions continue to pressure seafood processors and fishermen

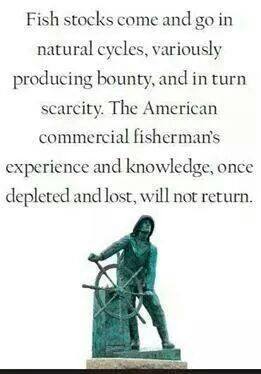

Consumers think of seafood as a premium purchase, which is not a good image when household budgets are tight and shoppers are worried about inflation. “The problem is not the fish,” said Jeremy Woodrow, executive director of the Alaska Seafood Marketing Institue. “The challenge is in the global marketplace.” Woodrow in February called the 2023 market for Alaska salmon “rock bottom” with low prices and weak demand, though maybe the industry was coming off that rocky bottom, he said then. Still, the pain is not gone. “A lot of buyers are barely holding on,” Woodrow said. “Our processors lost a lot of money the past year or two.” more, >>CLICK TO READ<< 09:40

Consumers think of seafood as a premium purchase, which is not a good image when household budgets are tight and shoppers are worried about inflation. “The problem is not the fish,” said Jeremy Woodrow, executive director of the Alaska Seafood Marketing Institue. “The challenge is in the global marketplace.” Woodrow in February called the 2023 market for Alaska salmon “rock bottom” with low prices and weak demand, though maybe the industry was coming off that rocky bottom, he said then. Still, the pain is not gone. “A lot of buyers are barely holding on,” Woodrow said. “Our processors lost a lot of money the past year or two.” more, >>CLICK TO READ<< 09:40

Woodrow officially takes director’s helm at ASMI

Alaska’s seafood industry has a new captain at the helm of its main marketing agency. Jeremy Woodrow, previously the organization’s communications director, officially took over as executive director of he Alaska Seafood Marketing Institute this June.,,, Though he’s not in commercial fishing at present, he said his family has a long history in it. That connection has helped inform his involvement in the ever-changing fisheries of Alaska, and though ASMI stays out of fisheries policy, there are plenty of other tangles to sort out. >click to read<19:19

US-China tariff battle takes a toll on some Alaska seafood processors, according to survey

Seafood processing businesses in Alaska are feeling the hurt from the U.S.-China tariff battle, according to the results of a survey from the Alaska Seafood Marketing Institute. Fourteen Alaska seafood processors responded to the survey, and 65 percent of those reported lost sales due to tariffs in China. Half of respondents reported delays in sales, and 36 percent reported lost customers. >click to read<16:54

Ukrainian seafood buyers want to connect with Unalaska’s fisheries

International seafood buyers are scheduled to visit Unalaska this month, but they don’t hail from a massive importer like China or Japan. They’re coming from Ukraine — a once-modest market for Alaska fish that’s slowly reemerging after political upheaval and economic crisis. In 2013, Ukraine spent $105 million on American seafood — a record for the Eastern European nation that loves hake, pollock and salmon roe. But two years later, those imports had plummeted almost 70 percent as the Ukrainian government was overthrown and parts of its land occupied by Russia. >click to read<21:22